hOW WE INVEST

THE RENAISSANCE PHILOSOPHY

Renaissance Smaller Companies employs an active approach to investment management, adopting a ‘bottom up’, value based philosophy. Renaissance’s investment philosophy seeks to exploit market inefficiencies that result in security prices deviating from an assessed valuation. This approach reflects the belief that, in the absence of structural change, security prices will ultimately tend toward their valuation through the course of an investment cycle.

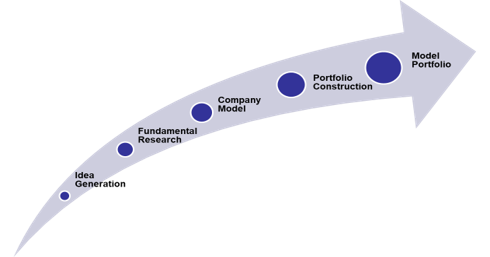

tHE RENAISSANCE PROCESS

At Renaissance Smaller Companies we identify opportunities by monitoring the difference between prevailing market prices and the assessed valuation. Most commonly this occurs due to behavioural inefficiencies (caused by sentiment or momentum driven price movements) or informational inefficiencies (situations where the market has mispriced securities due to incorrect assumptions or lack of recognition of change).

Renaissance believes that all companies (and therefore securities) no matter what they make or do, whether they are considered to be ‘growth’ or ‘value’ companies, can have a hard valuation attached to them. To ensure the accuracy and reliability of our valuations, we:

- Generate valuations based on rigorous ‘in-house’ research that are compared to external valuations in order to understand the reasons behind any valuation differentials

- Use multiple valuation measures (both absolute and relative) designed to take account of the specific attributes of the business being valued

- Construct valuations that capture all elements of a particular security, with specific reference to the future income streams of each of the businesses or assets

- Ensure that structural change is recognised and factored into expectations

- Test valuations for sensitivity to different macroeconomic conditions; and

- Assess the quality of company management and strategies

Renaissance recognises that the performance of each individual security is inherently uncertain. Portfolios are constructed to ensure that a prudent balance is maintained between risk and reward, with the aim of improving the consistency of investment returns over the medium to long term.

CORPORATE GOVERNANCE

At Renaissance, we believe we have the ability to influence companies to improve their management of environmental, social and governance (ESG) issues. We strongly believe that it is in the long term interest of shareholders for companies to adopt a strong and robust corporate governance framework and that this can be an important driver of investment value.

Renaissance actively encourages high standards of corporate governance for companies and trusts within our investment universe. The exercising of voting rights is an important tool that we use to influence companies to operate in the interest of investors (rather than in the interests of company management) and we will frequently commit resources to ensure this is the case. When exercising our voting rights we will always cast votes in the best interests of our clients.

Renaissance has been a member of ESG Research Australia (ESG RA) since its inception. ESG RA is an Australian association of superannuation funds, fund managers and asset consultants which has the objective of increasing the focus of stock broker research in Australia on ESG issues.

OUR FUNDS

Smaller Companies Fund

Click here to see our smaller companies fund!

Renaissance Asset Management

Smaller Companies FundEmerging Companies Fund

Click here to see our emerging companies fund!